US Debt Limit Reached

Wikimedia Commons

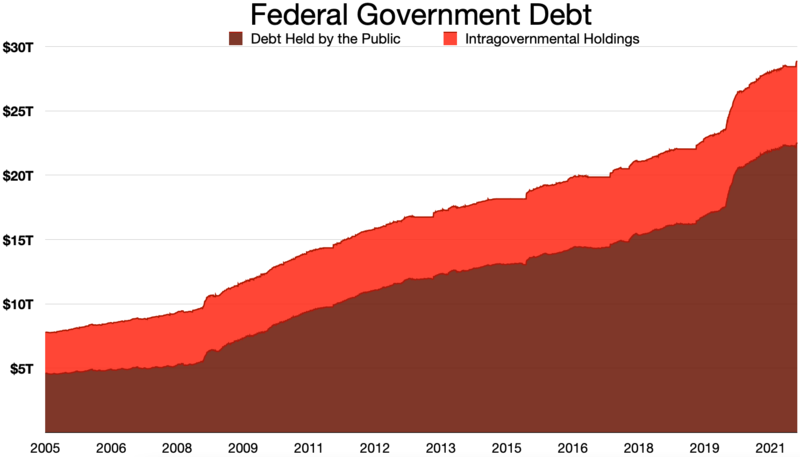

The government owes itself about 28 trillion dollars and owes the public about 23 trillion dollars in 2021.

Apr 4, 2023

The United States reached the debt limit (ceiling) of 31.4 trillion dollars in early 2023. The U.S. Treasury is currently using extraordinary measures in order to borrow more money for government activities by limiting the debt as much as possible.

Some of these extraordinary measures are made up of suspending investments in Thrift Savings Plan G Fund which is used to invest in one-day securities, suspending investments in Exchange Stabilization Fund which is used to stabilize foreign exchange rates, and suspending new securities for the Civil Service Retirement and Disability Fund which provides benefits to retired and disabled federal employees and the Postal Service Retiree Health Benefits Fund which provides health insurance to postal workers.

These measures, however, can only last for a few months, since the measures can only provide a limited amount of money to keep government activities and spending afloat. It’s predicted that the measures will run out of room to borrow at some point between July and September. Once this happens, the United States will either delay its spending in other areas or default entirely.

Congress is continuing to fail to raise the debt limit due to the politicization of the issue, and both main parties being unwilling to compromise. The Democrats are demanding to raise the debt limit now and discuss federal spending later while the Republicans are demanding immediate “budget cuts” before voting to raise the limit. The “budget cuts” haven’t been too specific. Usually, their cuts won’t involve the military, defense, or veteran benefits. This deadlock of demands takes up more and more time leading to the predicted default in the summer.

If the U.S. Treasury ends up defaulting, the result will be catastrophic. Federal workers won’t be able to get paid, financial assistance programs won’t be carried out, stocks will fall, and the U.S. credit rating will be lower which makes interest rates higher. This economic failure prediction makes the Congressional delay even more shocking.

The last time Congress raised the debt limit was mid-December in 2021. This means that the federal spending budget was able to last about a year and 33 days before debt reached the new limit again. This demonstrates a problem within the budget. The main debate is how the U.S. should fix its budget, so the country won’t have as much debt nor would it reach a new debt limit. Democrats usually advocate that taxes should be raised in order to raise revenue while Republicans advocate that spending should be cut in order to decrease expenses.

The U.S. debt limit being reached is itself an issue. However, it shows deeper problems within the United States budget that needs to be talked about, because if Congress just raises the debt limit, it would be reached again in the future.